Svasti raises US$ 5 million from Impact Investment Exchange's Women's Livelihood Bond, under the Orange Bond Initiative.

Svasti raises US$ 5 million from Impact Investment Exchange's Women's Livelihood Bond, under the Orange Bond Initiative.

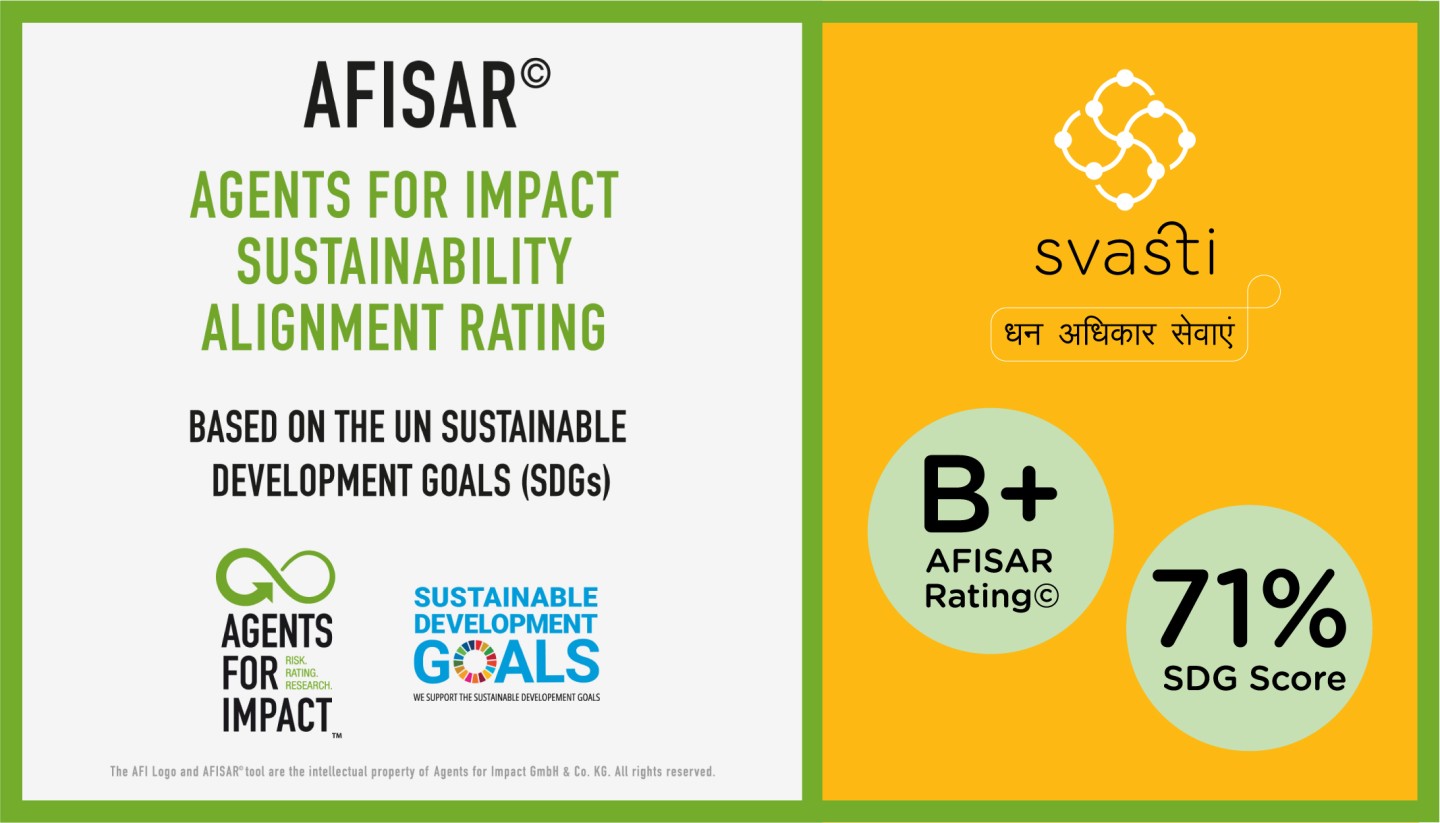

In line with our mission to pursue a positive impact by making the Right to Finance a reality for all, Svasti Microfinance Private Limited concluded a 3-year rating partnership with the German impact investing company “Agents for Impact”. The partnership ensures annual assessments of sustainability performance using the Agents for Impact Sustainability Rating Tool (AFISAR©).

According to the AFISAR© conducted for FY 2021, Svasti obtained a Rating of “B+” based on a score of 71% (above threshold). This result shows that our institution and operations are well aligned to the Sustainable Development Goals (SDGs), while we remain committed to enhancing our approach and practices even more.

Founded in 2018, Agents for Impact is a Germany-based impact investing company, with Agents spread globally, including in India. The company offers premium impact investment solutions, sustainability consulting, and impact measurement services tailormade for clients in the sustainable finance industry. We provide our partners with a combination of expertise and experience across the following three pillars: RISK – RATING – RESEARCH. Together with these partners, AFI pursues positive impact, contributing to the achievement of the SDGs as the common reference framework for sustainable development.

The Agents for Impact Sustainability Alignment Rating (AFISAR©) Tool assesses a company’s alignment to the SDGs, using a comprehensive set of sector-specific, qualitative/quantitative indicators at the institutional and portfolio levels. Thereby, the Tool responds to the increasing market demand for higher quality impact data. Following a holistic yet pragmatic approach, the AFI Rating Team analyses positive and negative impact as well as various sustainability risks. The annual rating results serve as a starting point for helping each company strengthen its sustainability performance (impact management), also by offering benchmarking to other organisations.

You may find more information about AFISAR© here.

Policy on viable Resolution Plan for the Company’s Borrowers who are in financial stress due to the adverse impact of Covid19 (including the Second Wave) on their livelihoods

1) Background

a) Many customers’ household incomes have been affected because of the disruption of their livelihoods/ economic activity due to COVID19, including the second wave of infections that commenced in February 2021

b) Post the moratorium period that ended on August 31, 2020, loan repayments have been due since 01-Sep-2020. The Company has adopted a Policy on Viable Resolution Plan for the Company’s Borrowers who are in financial stress due to the adverse impact of Covid19 on their livelihoods that was approved at its Board Meeting dated 19th November, 2020 (“Restructuring Policy 1.0”). Since September 2020, the Company’s collection efficiency has seen a steady improvement month on month until February 2021. However, the Second Wave of Covid19 commenced in Maharashtra in February 2020 and started expanding to other States in March and April 2021 leading to phased severe lock downs being implemented in several States. The Second Wave of Covid19 has had an adverse impact on the livelihoods of many of the Company’s customers, including some of those who have availed of restructuring of their loans under Restructuring Policy 1.0.

c) During interactions between our branch staff and customers at collection meetings and otherwise, many customers have expressed their difficulties in repaying their monthly/ weekly loan installments as per their existing amortization schedules due to disruptions in their livelihoods/ economic activities due to COVID19, including its Second Wave and they have requested our branch staff to consider giving them more time to make their repayments. Such customers have clearly expressed to us that they are both willing and able to make their repayments to us, provided we give them sufficient time to recover from the disruptions of COVID19, including its Second Wave, as they need this time to get their regular livelihoods/ economic activities back on track. They have assured us that the repayments as per the revised schedule shall not go into default.

d) As a result, we believe that it is necessary to give such customers more time to recover from the COVID19 disruption, including its Second Wave and then service their obligations. This would also ensure that the customer is not classified as NPA immediately resulting in further difficulty for the customer in going to their pre-COVID19 financial state.

Bags funding from Adar Poonawalla, NMI, and Rajiv Dadlani Group

India, 11th March, 2021: Svasti Microfinance Private Limited (Svasti) - an RBI Licensed MFI, has raised a total of INR 310 Million from its existing investors Mr. Adar Poonawalla, Nordic Microfinance Initiative (NMI), and Rajiv Dadlani Group.

Svasti was co-founded by Arunkumar Padmanabhan and Narayanan Subramaniam in 2010, with the objective of bringing their extensive experience in banking, finance, and technology development into the consumer finance sector, to fulfill the right to finance, and transform the lives of women, especially those uncounted millions who do not have any collateral to support their bids for finance, thus bringing about a positive change in society.

Svasti today services around 1,87,500 customers across 63 branches spread over 4 states, aggregating a loan portfolio of around INR 4 Billion. Over the years, Svasti’s portfolio quality has been among the best in the industry. In fact, Svasti’s post-pandemic collection efficiency has reached 94% and it expects both collections and disbursements to reach pre-pandemic levels by the end of this financial year. Svasti has also been certified as a Great Place to Work, for the second year in a row.

In 2015, Svasti raised funds from billionaire Mr. Adar Poonawalla, who had subsequently invested in all follow-on rounds and now in the current round as well. In 2018, Svasti raised funds from Nordic Microfinance Initiative, which has made follow-on investments in 2019 and again in the current round. The Company has raised a total of INR 1.3 Billion capital to date. Existing investors also include Sajid Fazalbhoy, Kayenne Ventures (Singapore), and Arihant Patni Family. To boost its capital base and fund its growth plans, Svasti would be raising around INR 1.5 Billion of equity in FY 2021-22.

In order to amplify their efforts, Svasti has built a proprietary fintech platform for its business, SvasTech, using cutting-edge technology embedded with artificial intelligence and machine learning.

SvasTech helps Svasti to completely control and comprehensively manage its operational risks using fully automated processes. SvasTech brings in higher levels of operational efficiency, which reduces redundancies, and helps Svasti significantly reduce operating costs. SvasTech also helps Svasti to better understand each of its customers, who are from the informal micro-enterprise sector.

Commenting on the efficiency of SvasTech and escalating growth this transaction anticipates, Svasti’s Co-Founder Narayanan says, “SvasTech is more than a fintech, it is a powerful, dynamic, empowering business tool unmatched in the microfinance industry. We have productively used the last few months, when normal business was disrupted due to the pandemic, to make substantial improvements and upgrades to SvasTech. We’re very excited about the potential and the possibilities that SvasTech opens up for us as we scale up our business in the coming years. Furthermore, the constant trust of existing investors in Svasti will support the plan to double our branches and grow our portfolio to INR 8 Billion by March 2022.”

Svasti’s Co-Founder Arunkumar added, “We have built a great organization with over 800 employees who are all very excited to receive such strong support and validation from our existing investors during these difficult times. Our team is energized to pursue our vision to become a diversified financial services provider to the millions of low and middle-income households across India. We have superior proprietary technology and analytics capabilities for our fintech platform, which we will further develop and leverage to build a top-quality consumer finance business that will be profitable and also have a high social impact. This round of investment from our existing investors motivates everyone associated to achieve our mission of fulfilling every woman's Right to Finance and help transform the lives of their families as well.”

Arthur Sletteberg, Managing Director of NMI, commenting on the transaction says, “We are very happy with the manner in which Svasti has taken up and managed the challenges of the pandemic that has adversely impacted various businesses globally. We have a lot of faith in the Svasti team’s ability to navigate these challenges and to emerge as one of the leading companies in its sector in the coming years.”

---

About Svasti: Svasti is an RBI licensed NBFC-MFI with headquarters in Mumbai. Svasti’s vision is to fulfill the right to finance of women with a host of financial services and knowledge, that will help transform their lives.

About Nordic Microfinance Initiative (NMI): NMI invests in microfinance institutions (MFIs) in Asia and Africa, strictly focusing on double bottom line investments, where both financial and social goals are met. NMI is a public-private partnership, owned by the Norwegian and Danish governmental funds for developing countries (Norfund and IFU) and large private sector institutions. Through 11 years of operation, NMI manages aggregated commitments of USD 370 Million. Presently, NMI holds 26 investments. NMI’s headquarter is in Oslo, Norway, with offices in New Delhi (India), Copenhagen (Denmark), and Nairobi (Kenya). Read more about NMI at https://www.nmimicro.no

About Mr. Adar Poonawalla: Mr. Adar Poonawalla is the chief executive officer (CEO) and executive director of Serum Institute of India, the world's largest vaccine manufacturer by number of doses produced. In 2016, he was listed by GQ magazine as one of the 50 most influential young Indians and was awarded Philanthropist of the year. In 2016, he launched www.adarpcleancity.com, a citywide initiative where he committed and spent USD 20 Million to clean up the city of Pune using hundreds of trucks, Glutton machines and bins across the city under his personal management and dedicated team. In 2018, received the CNBC Asia’s award for Corporate Social Responsibility of the year. Read more about Mr. Adar Poonawalla at http://www.adarpoonawalla.com/

---

For more information about this round of funding, please contact us.

For any media related queries, feel free to reach out to:

Ms. Tanya Shandilya | Email: [email protected]

Ms. Maitri Satra | Email: [email protected]

Svasti Microfinance Private Limited (Svasti) has raised a total of USD 10 Million capital from Nordic Microfinance Initiative (NMI), Mr. Adar Poonawalla, and Rajiv Dadlani Group.

In 2015, Svasti raised funds from leading businessman and philanthropist Mr. Adar Poonawalla, who has subsequently invested in follow-on rounds in 2017, 2018, and in the current round as well. In 2018, Svasti raised funds from Nordic Microfinance Initiative, that has also invested again in the current round. In addition, in the current round, Svasti has raised funds from family offices of Nalwalas (Dubai), Kayenne Ventures (Singapore) the investment vehicle of siblings Kajal & Navin Fabiani, Patnis (Mumbai) and other HNIs led by the Rajiv Dadlani Group. Till date, Svasti has raised total capital funds of Rs. 115 Crores.

Apart from expanding its branch network, Svasti will use the capital raised to expand and increase its MSME loan portfolio and provide other financial services, such as consumer finance and insurance, in partnership with other leading institutions.

Early investors in Svasti include the Michael & Susan Dell Foundation, Bamboo Financial Inclusion Fund, venture capitalist Mr. Sajid Fazalbhoy, and investment banker and angel investor Mr. Rajiv Dadlani. A portion of the funds raised in the current round are being used to provide full exits to the Michael & Susan Dell Foundation and Bamboo Financial Inclusion Fund.

Svasti was co-founded by Arunkumar Padmanabhan and Narayanan Subramaniam in 2010 with the objective of bringing their extensive experience in banking, finance and technology development into the consumer finance sector to expand access to finance to all sections of society and bring about positive change in society.

Svasti today services around 185,000 customers across 52 branches spread over 4 states, aggregating a loan portfolio of around Rs. 380 Crores. Over the years, Svasti’s portfolio quality has been among the best in the industry. Svasti aims to reach total loan portfolio of Rs. 550 Crores by FY 2020 and Rs. 1,100 Crores by FY 2021.

Commenting on the transaction, Svasti’s Co-Founder Narayanan says: “We are very pleased to have closed this fund raise within a year of our previous fund raise. This gives us adequate capital funds to meet our growth plans until March 2021.”

Svasti’s Co-Founder Arunkumar added: “We have built a great organization with over 700 employees who are all very excited to receive such strong support from our investors. Our team is energized to pursue our vision to become a diversified financial services provider to the millions of low-income and middle-income households across India. We have superior proprietary technology and analytics capabilities, which we will further develop and leverage to build a top-quality consumer finance business that will be profitable and also have high social impact.”

Arthur Sletteberg, Managing Director of NMI, commenting on the transaction says: “We are very happy with the progress Svasti has made since our initial investment last year and are glad to support the Company in continuing its momentum to scale its business and build a high-quality portfolio in the underserved markets.”

-----

Note: Data of Employees, Branches, Customers, and Portfolio in INR Crores, displayed on this website, is as of 7th April 2025.

Registered Office:

6, First Floor, First Street, Tiger Varadachari Road, Kalakshetra Colony, Besant Nagar,

Chennai 600 090, Tamil Nadu.

Corporate Office:

501-502 Opal Square IT Park, C-1 S.G. Barve Road, Wagle Estate, Thane (West) 400 604, Maharashtra.

Daily: 9:30 am - 6:30 pm

Sunday: Closed

Copyright © 2008-2024 Svasti Microfinance | Website by Digital5