Environmental, Social, and Governance (ESG) Framework

at Svasti Microfinance

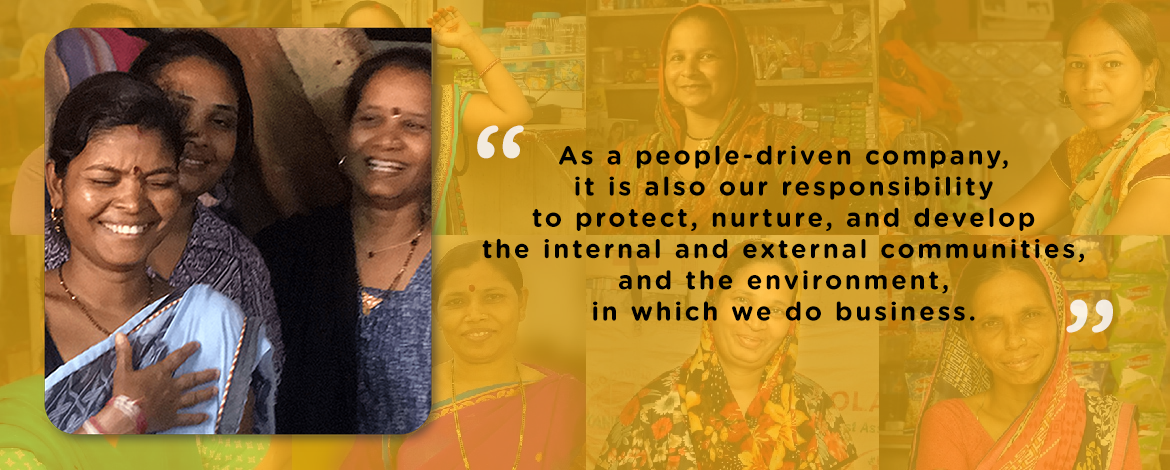

Svasti, since its inception, has been committed to providing high-quality financial services to low-income households.

Over the years, Svasti has committed to and adhered to various elements of responsible finance, social performance, and corporate governance.

Most of the standards globally recognized as Environmental, Social, and Governance (ESG) frameworks were already integrated into Svasti’s business operations. A testament to this has been various external ratings received by Svasti over the years.

Given the evolution of the ESG framework globally and within India, Svasti understands the need to consolidate its work on these elements into a formal ESG Policy.

Svasti also recognizes the importance of adopting ESG Frameworks as a form of risk mitigation and as a framework that can help the organization stay focused on sustainable growth while ensuring customers’ and employees’ well-being.

You can view the various ratings and certifications Svasti has received over the years, on our performance page, or via the images below.

ESG Policy Framework

at Svasti Microfinance

Environmental Performance

Svasti recognizes and acknowledges the need to integrate environmental performance in its business strategy and systems.

Put in place Environment Strategy and Systems: Svasti identified environmental goals and corresponding metrics to measure environmental performance. It has started to track the data (eg., energy consumption, water consumption, loan portfolio of green products, and others) in this regard.

Adopted Green Practices: Svasti identifies and adopts green practices to reduce its internal energy footprint by reducing energy and water consumption and managing waste.

Put in place a climate change strategy: Svasti abstains from lending to environmentally irresponsible projects. In this regard, it adheres to the IFC exclusion (prohibited activities) list for microfinance institutions. As a part of its risk management and business continuity planning, it will assess the vulnerability of its properties, buildings, and human resources to climate shocks.

Social

Performance

Svasti adopted responsible finance practices including building customer centric processes and responsible employee engagement.

Social Performance Strategy and Goals in Place: Svasti documented social goals and indicators which are used to measure social performance. It regularly collects, analyses, reports, and uses social performance and customer protection-related data.

Offers Customer-centred Products and Services: It has established processes to gather client feedback from which feeds into product refinement. Three types of surveys were conducted - customer satisfaction survey, customer exit survey, and post-disbursement surveys.

Adheres to all National-level Code of Conduct Guidelines and Global Best Practices on Client Protection Principles: This includes having strategies and processes around the prevention of over-indebtedness, transparency, fair and respectful treatment of clients, responsible collection practices, strong complaint mechanisms, and protection of customer data.

Responsible Employer: Svasti's people-first strategy gives utmost importance to the well-being of its employees. Svasti strives to promote diversity, equity, and inclusion within the organization and provide adequate awareness of human rights. Svasti is committed to upholding employee rights and treating them with dignity by providing a professional work environment. Policies are in place to ensure employee well-being.

Board-approved Corporate Social Responsibility Policy in Place: Svasti constituted CSR Committee at the Board as per the requirements of Section 135 of the Companies Act, 2013 and Companies (Corporate Social Responsibility Policy) Rules, 2014. All the activities are taken up as per Svasti’s CSR Policy.

Committed Leadership and Oversight of Social Goals and Customer Protection: Board has an ESG Committee which oversees social and environmental performance. The Board signs the Code of Conduct and receives training or orientation on their social performance responsibilities from time to time. Every quarter, an ESG report is tabled for the Board. Board’s nomination committee oversees executive compensation. The founders’ performance evaluation includes social performance targets/criteria.

Responsible Growth and Returns: Growth rates and portfolio quality at institutional and branch levels are monitored weekly and monthly against targets to identify the variance and potential issues.

Corporate Governance

Corporate governance is at the core of Svasti’s functioning. Svasti adopted good corporate governance practices based on the international best practices.

Effective Board Composition and Functioning: Svasti constitutes and maintains a Board of Directors as per the provisions of the Indian Companies Act, 2013.

Put in place robust Compliance, Risk Management, and Internal Audit Systems: Svasti meets all the statutory obligations in line with both the letter and spirit of law. There are policies and processes to help avoid conflicts of interest and adopt minimum expected standards around anti-bribery and anti-corruption. There is a risk management framework and internal audit mechanism. The internal audit team reports directly to the Board audit committee.

Adheres to Complete Disclosure and Transparency: Svasti Is committed to being a transparent organization. It has put in place a whistle-blower mechanism using which the employees can report to the management their concerns about unethical behaviour, actual or suspected fraud, violation of code of conduct policy, or any major process violation.

SVASTI MICROFINANCE SOCIAL AND ENVIRONMENTAL GOALS

Svasti Social Goals

---

Svasti has documented social goals and identified indicators to measure social performance. Data for measurement includes internal data, gathered as part of the loan application process, credit bureau data analysis, and external sources like the 60 Decibels Microfinance Index Survey in which Svasti participated.

1

Our Intent

Help positively transform the lives of enterprising women from economically challenged sections of society.

A targeted increase in the number of women empowered.

Percentage of women who access formal loans for the first time.

Percentage of women from marginalized sections of society.

2

Our Offerings

A range of financially empowering products and services customised to customer needs.

Financial well-being measured by increased confidence and participation in the family's financial matters, and contribution to meeting the family's financial security goals.

Social and economic transformation measured by the increased income, household and business assets, and the continued education of children.

Resilience measured by the ability to manage financial challenges, increase savings, and secure themselves with insurance.

3

Service Quality

We will lend responsibly, and deliver what we promise, with respect, transparency, and efficiency.

Social Rating Grades, and Net Promoter Scores on Client Satisfaction

Quality of service measured by customer loyalty through repeat loans and multiple products taken.

Customer satisfaction based on complaints to resolution ratio.

4

Our Culture

Fairness, innovation, responsibility, service orientation, and technology, for employee and customer benefit.

Employee satisfaction measured by our staff retention ratio, and an Annual Great Places to Work survey.

Svasti Environment Goals

---

Svasti has identified environmental goals and corresponding metrics to measure its environmental performance. Data for measurement comes from internal sources based on global best practices followed for this purpose.

1

Reduce Impact on The Environment

Svasti aims to constantly find ways to reduce its energy footprint and its waste production, in all its offices across the country.

Reduction of total water and electricity consumption.

Reduction in the consumption and waste of materials like paper, plastic, glass, food, and green residual waste.

2

Reduce Client Vulnerability to Climate Change

Increase customers' access to products that help them adapt to adversity like climate change and environmental degradation.

The number of clients reached with WASH loans that ensure reliable, climate-resilient water and sanitation services.

The number of affordable housing loans disbursed.

The number of customers reached with environment and climate-change-related messages.

3

Enforce Financial Exclusions Lists

Stop lending that causes adverse impacts on the environment, by strictly adhering to prescribed financial exclusions lists.

4

Adopt Green Practices and Technology

Encourage customers to adopt environment-friendly lifestyles and adopt green technologies in their homes and in their work.

The number of outstanding Green loans.

Gross Loan Portfolio for Green products and technologies.

Loan portfolio segmentation by sectors, like sustainable agriculture, renewable energy, and waste management.

The number of customers reached with environment and climate-change-related communication.

Svasti Performance Summary

60_decibels Report

ESG Reporting at Svasti

ESG framework reports and results are presented to the Svasti Board every year using the SPI online tool developed by CERISE. Svasti also seeks third-party evaluation of its performance on environmental and social ratings, sustainability ratings (by the Agents for Impact), client protection certification, and code of conduct assessment.