Svasti Microfinance Loans

Leveraging the Power of Five!

Svasti's unique Joint Liability Group (JLG) Microfinance loans provide groups of women loans ranging from thirty-two thousand to one-lakh-four-thousand rupees, to finance business setup, expansion, or extension.

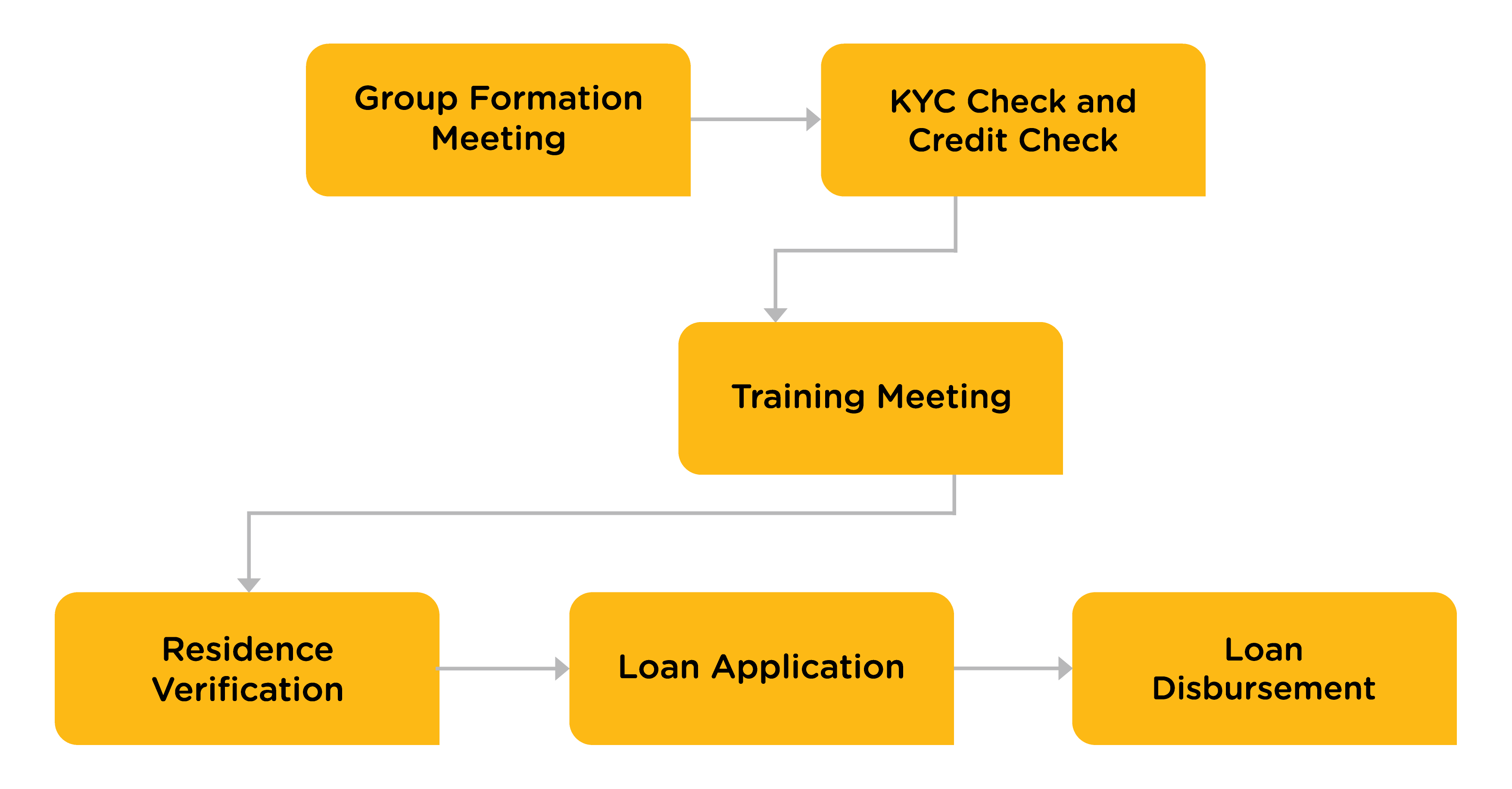

Svasti JLG Microfinance loans are provided with less emphasis on documentation, and more emphasis on trust. Our unique and transparent loan approval and disbursement process takes just one week from start to end, with the acceptance or rejection of the loan application being given on-the-spot!

The Loan Origination Process

![]()

On the spot

Loan Status

The loan approval process for

Svasti Joint Liability Group (JLG)

Microfinance is transparent and

its status is provided on-the-spot

using smart technology.

![]()

Minimum

Documentation

JLG Microfinance applicants who

fulfill basic KYC requirements

and have a group guarantee, get

on-the-spot indication of loan

approval status, by our team.

![]()

Easy Borrowing

and Repayment

Disbursement of the loan aside

all interactions between Svasti

and our customers take place

conveniently, at the residence

or workplace of our customers.